Introduction

Jeff Bezos is one of the most influential business figures of the modern era. From building Amazon in a garage to shaping the future of space exploration, his financial journey reflects long term vision rather than short term wins.In 2026, Jeff Bezos Net Worth 2026 remains a hot search topic among USA readers, investors, and tech enthusiasts.

People want to understand how his wealth is structured, where it comes from, and whether it can still grow.This article breaks down Bezos’s net worth in a clear, data-driven way covering Amazon, Blue Origin, investments, and long term wealth strategy without hype or speculation.

Who Jeff Bezos Is in 2026

Jeff Bezos is best known as the founder of Amazon, the world’s largest ecommerce and cloud computing company.

Although he stepped down as Amazon’s CEO in 2021, Bezos remains deeply involved at a strategic level. In 2026, his focus has shifted toward long term ventures rather than daily operations.

His primary areas of attention include:

- Expanding Amazon’s long term value

- Scaling Blue Origin as a serious space competitor

- Managing his private investment arm, Bezos Expeditions

- Philanthropy and scientific initiatives

Bezos in 2026 is less of a day to-day executive and more of a visionary capital allocator.

Jeff Bezos Net Worth 2026 (Estimated & Explained)

As of 2026, Jeff Bezos Net Worth 2026 is estimated between $190 billion and $210 billion USD.

Why estimates vary

Net worth estimates differ because:

- Amazon stock price fluctuates daily

- Blue Origin is a private company with no public valuation

- Private investments are difficult to price accurately

Public vs private assets

Bezos’s wealth is split between:

- Public assets: Amazon shares (easily valued)

- Private assets: Blue Origin, startups, real estate, and media

Most tracking platforms focus heavily on Amazon, which explains the range rather than a fixed number.

Jeff Bezos’s Business Empire Overview

Jeff Bezos’s business empire is diversified but strategically aligned.

Core pillars of his empire:

- Amazon Ecommerce, AWS, logistics, AI

- Blue Origin Space technology and launch systems

- Bezos Expeditions Private investment firm

- Media & real estate Washington Post and global properties

This diversification protects his wealth from dependence on a single sector.

Amazon The Core of Jeff Bezos’s Wealth

Amazon remains the largest contributor to Amazon founder net worth.

Ownership percentage

In 2026, Bezos owns approximately 9–10% of Amazon, even after years of stock sales and charitable donations.

Amazon revenue & valuation 2026

- Estimated annual revenue: $700+ billion

- Estimated market valuation: $1.8–2.2 trillion

AWS importance

Amazon Web Services (AWS) is the profit engine:

- Higher margins than retail

- Dominates enterprise cloud infrastructure

- Key driver of Amazon valuation 2026

Without AWS, Amazon’s valuation would look very different.

Blue Origin Space Ambitions & Future Value

Blue Origin reflects Bezos’s long-term belief in space based industries.

Blue Origin’s mission

The company focuses on:

- Reusable launch vehicles

- Commercial spaceflight

- Orbital infrastructure

Estimated valuation

As a private company, estimates vary, but Blue Origin valuation is widely placed between $15–20 billion in 2026.

Competition with SpaceX

Compared to SpaceX, Blue Origin is:

- Slower in launches

- More research focused

- Privately funded by Bezos

While not as commercially aggressive, Blue Origin represents long term upside rather than short term profit.

Jeff Bezos Investment Portfolio

Bezos invests through Bezos Expeditions, his personal investment firm.

Key investment categories

- Technology startups (AI, SaaS, fintech)

- Consumer brands

- Healthcare and biotech

- Media and information platforms

Media investments

Bezos owns The Washington Post, which is not a profit machine but adds influence, credibility, and long term brand value.

His investment approach favors patient capital over fast exits.

Jeff Bezos Income Sources Breakdown

Bezos does not rely on salary.

His income is primarily equity driven.

Income sources table

| Source | Type | Estimated Contribution |

| Amazon shares | Equity appreciation | Very High |

| Amazon stock sales | Liquidity | Medium |

| Blue Origin | Private equity | Long term |

| Bezos Expeditions | Startup investments | Medium |

| Real estate & media | Asset value | Low Medium |

Salary is negligible compared to capital gains.

Lifestyle, Assets & Spending Philosophy

Jeff Bezos lives comfortably but not recklessly.

Real estate

His properties span:

- New York

- Washington D.C.

- Texas

- Hawaii

Combined real estate value is estimated in the hundreds of millions USD.

Luxury assets

- Superyachts

- Private aviation access

- High end security and logistics

Philanthropy

Bezos funds:

- Climate initiatives

- Education programs

- Scientific research

His giving has increased significantly post CEO era.

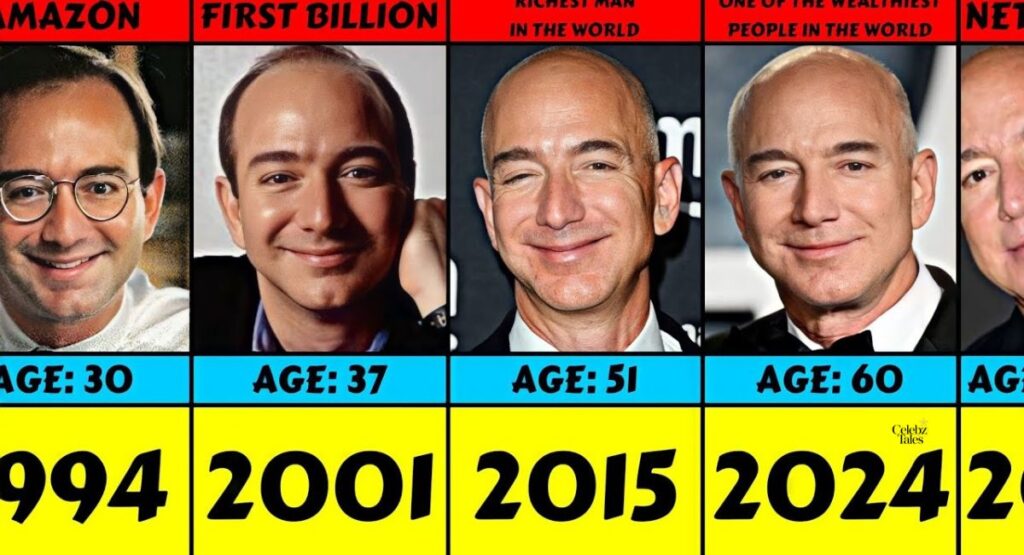

Jeff Bezos Net Worth Growth Timeline

A long-term view shows how steadily his wealth grew.

Year by year overview

- 1997 Amazon IPO, Bezos becomes millionaire

- 2000 Dot-com crash, wealth drops sharply

- 2010 Amazon scales globally

- 2017 Crosses $100B net worth

- 2020 Pandemic driven Amazon surge

- 2023 Wealth stabilizes after diversification

- 2026 Estimated $190–210B

This timeline shows resilience through multiple economic cycles.

Jeff Bezos vs Other Billionaires

Comparison table

| Billionaire | Primary Wealth Source | Net Worth 2026 (Est.) |

| Jeff Bezos | Amazon, investments | $190–210B |

| Elon Musk | Tesla, SpaceX | Higher volatility |

| Mark Zuckerberg | Meta Platforms | Lower than Bezos |

| Bill Gates | Microsoft, investments | More diversified |

Bezos stands out for consistency rather than volatility.

Future Outlook Can Jeff Bezos’s Net Worth Grow After 2026?

Opportunities

- AWS expansion

- Space industry growth

- AI driven logistics

- Long term startup bets

Risks

- Amazon regulation

- Market downturns

- Space sector capital intensity

Long term outlook

Bezos’s wealth strategy is built for decades, not quarters. Growth may slow, but stability remains strong.

FAQs

Is Jeff Bezos the richest person in 2026?

He is among the top three globally, depending on market conditions.

How much of Amazon does Jeff Bezos own?

Roughly 9–10% as of 2026.

Is Blue Origin profitable?

No. It is still in heavy investment mode.

Does Jeff Bezos still earn from Amazon?

Yes, primarily through equity appreciation and stock sales.

Conclusion

Jeff Bezos Net Worth 2026 is not just a number it represents one of the most carefully built business empires in modern history.With Amazon as the foundation, Blue Origin as the future bet, and a wide investment portfolio, Bezos remains a dominant force in global business.

His power comes not from headlines, but from long term thinking, disciplined capital allocation, and strategic patience qualities that continue to define his success well beyond 2026.

Welcome to Celebz Tales! I’m WAZEER ALI, Owner, Admin, and Author of this Website.

1 thought on “Jeff Bezos Net Worth 2026: Amazon, Blue Origin & Investment Empire Explained”